Have a Question?

Interested to Partner with Us?

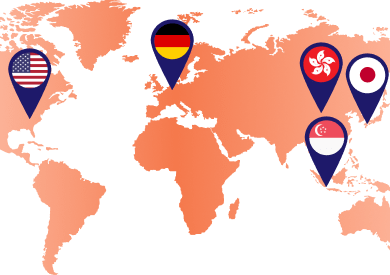

Where we are located

FAQ

Yes. Our solution is designed for small & medium sized banks and financial institutions and is available in your country through Local Partners and System Integrators.

Since our SIMBAS solution is created using APIs from third party FinTechs, we are open to integrating your FinTech solution into our SIMBAS Small Bank System.

Yes. SIMBAS has Apps that work in booth online as well as offline mode. Depending on your requirements, we can offer both options so your customers will always be able to run the mobile App in online and offline mode (with some functions disabled during offline mode).

SIMBAS is completely parameterized solution and the Products parameters like interest rates can be varied based on bank preferences.

We are open to partnerships with local system integrators as they will be able to help tailor our solution to local market conditions.

SIMBAS has been designed to be extensible. We have FinTechs who offer trade finance and SME services and we can offer these solutions by integrating these FinTechs into the SIMBAS Small Bank system?

SIMBAS has been developed to run in either a single bank instance (either on-premise or cloud) or it can be deployed in a multi-bank cloud environment for a group of banks as a BaaS model.

Our pricing structure is based on low upfront setup fees and a monthly fee based on usage by the customers of the financial institutions. Our intent is to offer a Pay-as-you-go pricing model to each bank. For more details on pricing, please contact us using the form above.

Interested to Learn More?

Launch your own full service Digital Bank with SIMBAS in months, not years.

Targeting the small and medium banks to digitize their banking systems.